A lot has changed even in the last six months in the world of competitive intelligence, this post, the first of three, attempts to share the kinds of analysis you can do in the area of Search, Websites, Display and Ads (content networks).

In the past I have written about the why, what & how to choose Competitive Intelligence Tools [ComScore, Alexa, HitWise, Compete etc]. That was followed by a lovely article on Metrics, Tips & Best Practices in doing competitive intelligence analysis. Finally there was some fun stuff with Microsoft AdCenter Labs in the Advanced Web Analytics post.

But until now not Google.

The reason was that the tools that Google provided were cool but I was unsure how they provided actionable insights. [And I am the Analytics Evangelist at Google!]

That changed recently with a group of tools the provide actionable trends and insights. My hope with these posts is to share what these tools do that I like, but that’s 20%. 80% of my hope is to teach you how to think, and what you can do regardless of what tool you use.

Here’s the first one: Google Trends for Websites .

First thing you can see in the tool: Daily Unique Visitors. And if you are logged in then you see the actual number. And if you eyeball the graph you’ll see the trend, going down over time in the above case and rising like the phoenix in July!

[sidebar]

Long time readers of this blog know that Daily Unique Visitors is not a metric I am too fond of, especially if you are using a web analytics tool on your website. If you want to use a daily metric as a KPI then use Daily Visits (sessions), not Daily Unique Visitors which is sub optimal for a number of reasons. For competitive intelligence it matters less, you are comparing apples to apple.

[/sidebar]

It is sad that most people leave the tool with the above graph, for themselves of their competitors. But there’s more. Here are two other things you can use.

Do this simple thing first, switch the geography setting to All Regions and here you go dear, here’s how your competitor is doing internationally:

Looks like WebTrends gets half of its traffic internationally, and it contributes enough to actually reduce the slope of the curve (the one in the US is steeper, reflecting a worse situation in the US).

[sidebar]

Since this will come up in many people’s mind, the Trends data for any site, and obviously not for www.webtrends.com (!), is Not from Google Analytics. The GA team has said in a recent post: “Google Analytics doesn’t share individual, site-level information with Google Trends for Websites or Google Ad Planner.” Read more context on the team’s official blog.

[/sidebar]

So you wonder, what’s the make up of the international markets? Here you go. . . .

The thing to do is correlate this with other pieces of data you have. For example I notice that India has actually become #2 referrer on my blog as well so it is interesting that WebTrends is seeing the same, well, trend. So it seems to be inline with expectations.

You might have other sources of data that you can correlate this with. For example you could look at that data just by the US and match it up with where your competitor has retail box stores, so maybe you can exploit a gap there.

And finally you get sites that Visitors who go to your competition visit, and top search terms they use. . . .

This is getting to know a few different things, mostly around the “persona” and “preferences” of the kinds of Visitors who go to a site. The bigger the site the most interesting this data is (especially when there are more keywords filled out in the Also Searched For part above).

As I look at the data I am very surprised that there is such a overlap between ClickTracks and WebTrends visitors. I would have expected Omniture to be higher in the list. It raises a few questions:

Do WebTrends customers (many of whom are still log file based – not that there’s anything wrong with that) think the cost is an issue and hence considering switching to ClickTracks?

Webposition Gold is used for SEO purposes, and is owned by WebTrends. Is that causing only a certain type of visitors to come to the website?

Are Clickz and MarketingSherpa the cutting edge of Analytical personas that WebTrends should have a overlap with?

One of the challenges WebTrends has faced is that of traditionally selling to IT while its newer competitors have sold to Marketers/Business folks. I am not surprised to see sphinn and mattcutts.com on the list, but perhaps those are not the persona of a typical chq signing Marketing Executive. Is that a challenge for WebTrends?

See how that list is making me think about the “persona” and “preferences” for www.webtrends.com visitors? Do that for your competition, there is a wealth of insights (questions you should be asking) in the data.

As you might have guessed by now, all of the above was just foreplay (very important for a higher climax!).

Measuring individual sites (yours or competitor) is good but the real fun in this is comparing trends. That will give you the key context you need to make even more sense of this competitive data.

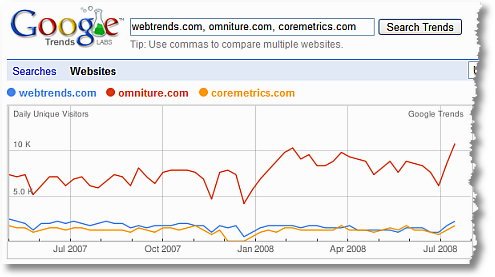

So I did exactly that. . . .

Ahhh…. sweet sweet data!

Don’t focus on the actual numbers (you’ll notice I say this a lot in this post). You want to compare the trends and each line gives context to the other two. That is deeply meaningful.

So what does it show?

WebTrends was rising like a phoenix in the US in July 2008 but Omniture seems to be rising like a …. hmm …. what’s a bird that is native to Utah? Can’t think of one. But I am sure there is a good one.

Knowing that there is a general spike in the industry that is causing an uptick gives me a  new benchmark to compare my own performance. If I had sunk in $5 million in marketing campaigns, as WT or Core, then this graph also gives me food for thought: Were my marketing campaigns responsible for the spike in visitors, or was it Omniture’s campaigns that just caused a industry wide halo effect?

new benchmark to compare my own performance. If I had sunk in $5 million in marketing campaigns, as WT or Core, then this graph also gives me food for thought: Were my marketing campaigns responsible for the spike in visitors, or was it Omniture’s campaigns that just caused a industry wide halo effect?

Also what the heck did Omniture do to cause that massive rise in traffic between end of dec 2007 and Feb 2008? Whatever they did seems to have put them on a new curve and they seems to have stayed on it since then.

Good Marketers (and great Analysts) show their true mettle by answering those questions, and then using the answer as information to optimize their own marketing strategies.

Here is one another important question the above graph raises:

Does it actually matter what an “Analyst” thinks of how each vendor should rank in this report or that? Should Omniture really sweat that they got ranked Wave One or Gold Circle or Tier One Beauty? Likewise for CoreMetrics can that Blue Ribbon “Top Cow of the Show” matter in the face of this actual Visitors behavior?

Should they (or WebTrends or Omniture) reconsider how these otherwise great companies do online marketing to get “share of voice”?

Yes.

For starters they can use their own tools, which are actually pretty good. : )

Did you see all that in three lines on a competitive intelligence graph?

That brings me to a very important recommendation: Doing competitive intelligence analysis without knowing enough context about your competitive space, your general ecosystem, is like going to play a football game naked. Won’t lead to a great outcome for you (even if you paid a ton of money for your players – tools :)).

I can make better sense of those lines because of what I know of the ecosystem, then the visitor behavior screams out the insights.

Last bit of insights you can look for: Are there strengths of my competitors that I can benefit from, are there weaknesses that I can exploit?

The Also Visited report can help a bit.

You can look at this report from the perspective of any site, I am going to look at the data from the perspective of Omniture.

Some of the above is hardly surprising, #1 and #4 for example.

But others are quite interesting.

Omniture’s worldwide series of summits are #2 in the list, and quite a nice amount of traffic at that. Since they are essentially Omniture “propaganda” (sorry Matt), it is great to see that it is effective. It raises the question, do the summits and CoreMetrics and WebTrends do give them a similar share of voice?

I am sure Omniture, WebTrends and CoreMetrics use # of attendees to measure success of their summits. How about using the above to measure success as well? Holistic impact measurement baby!

Here’s another data point that is noteworthy. Both CoreMetrics and Omniture seem to benefit from a big overlap with webanalyticsassociation.org. Why not WebTrends? One of the oldest members of the WAA community and a early founder. Is the WAA biased and sends more traffic to the other two and not WT? Why don’t WebTrends visitors have any overlap with those that visit waa.org? Cause for concern and investigation.

Please try it with different perspectives using the drop down immediately above the report, it can be insightful. Here’s an example of that report and comparison for www.lowes.com and www.homedepot.com. . . .

See the #1 for Lowes? Scary!

Also notice the commonalities between the two and the differences. Each of that is a set of information you can use to your advantage.

Had fun? I want to point out that my hope was less to get you to use Google Trends for Websites, more to teach you how to think as you approach competitive intelligence data. I hope you learned something.

And to the CMO’s of Omniture, WebTrends & CoreMetrics: Analysis like this is expensive! If you found value in this analysis by a expensive Analyst :), please make a donation to the two charities this blog supports (Doctors Without Borders, The Smile Train). Thanks!

Lastly, two important questions (probably on your mind):

#1: Is this data from Google any good?

You know me so well, great question!

For me any source of data is only as good as understanding exactly how it is captured. Hence this link at the start of this blog post: Competitive Intelligence Tools.

Google has publicly stated that it uses multiple sources of data it has access to in order to provide the data you see in Trends. Please check out “Information for Website Owners “.

My personal perspective is that as currently Google is used a decent amount in terms of its products and services which means that it has aggregated permission based non-PII (personally identifiable information) that is useful. The sample size also is favorably positioned compared to other options adding to its usefulness.

My personal perspective is that as currently Google is used a decent amount in terms of its products and services which means that it has aggregated permission based non-PII (personally identifiable information) that is useful. The sample size also is favorably positioned compared to other options adding to its usefulness.

It is important to know that each data source has a natural bias.

Panel based measurements use a very small sample of people, capture their browsing behavior using “monitoring software” which means they can give deeper information on a few widely used sites.

ISP based measurements typically have much larger sample sizes but shallower site level data.

Likewise Google’s data, which is a mix of sources, probably has a “searcher’s bias”, i.e. people who use search engines.

Educate yourself and make the optimal decision for your case.

#2: Does this type of product from Google mean the end of Alexa, Nielsen, Compete, HitWise, ComScore?

Hardly.

Each tool provides something interesting of value. Some might become less relevant than others, but I can’t imagine any scenario where there won’t be anything but robust competition.

Here’s how I bucket them by value:

Deep within a site behavior (if over five million unique visitors a month) = comScore.

Free clickstream metrics (plus paid pro version) = Compete.

Deep search and clickstream (non free) = HitWise.

Free clickstream and search metrics (not expansive) = Google.

If it is of some value let me do my own personal quick walk thru of the tools (which will also reveal any bias I have).

Alexa was useful in the past but it is a less than optimal source for anything now. Ever since Compete showed up there is no need to use Alexa because compete data is on a bigger sample set, using multiple sources and more accurate. Yes it does not rank but really at the end of the day do you want a rank or better data?

Both Nielsen and ComScore have been under a heavy threat for some time because of the way they collect data (not from other companies!). Panel based measurement using “monitoring software” poses a sampling and population bias that has become much more of a challenge as the web has grown massively and become more rich / fluid / web 2.0.

Compete and HitWise are both ISP based services and frequent readers of this blog know that I am quite fond of them. Until recently when I lost access to Compete I used it all the time here and in my presentations because I think it has probably the most rich set of data sources (ISP, surveys, “monitoring software”, even panels). If you have money to spend on competitive intelligence (and you should) then HitWise with its ISP based data is great source (with one of the largest sample of users in its database).

To help you think here’s a metaphor for Panel and ISP based data:

Until last year the generally accepted wisdom on which commercials were best was the USA Today ranking. It was based on 302 people (!). 302 people representing the opinion of several hundred million who watched the show (and for commercials! :)). Last year the commercials were all on YouTube and were ranked by a 1.5 million YouTube Users.

Which one do you think is more accurate?

I think of Panel Based services services as the USA Today method. ISP based as the YouTube method. Not absolutely perfect, but a significantly better signal to noise ratio.

Google’s data is perhaps like ISP data in the sense that it is based on clicks.

I expect Nielsen and ComScore to radically evolve their data capture mechanisms, which would enhance what they provide today (deep site behavior data). Even today if your site gets more than five million unique visitors a month you can use panel based data with some confidence.

I tend to use Compete because it has more metrics and reports, even the free version. And I use it to index against what Google might be providing. Like this:

Long term I confidently expect most tools to thrive and improve. Including Google’s.

[sidebar]

This goes without saying but no tool will actually show you really good data about your blog. In most cases if you don’t get more than 50,000 visits a month even the wrong data won’t be right. Just a quick tip.

[/sidebar]

Source : www.kaushik.net

Thanks for reading, Have a nice day :)!!! Suscribe my post

Tidak ada komentar:

Posting Komentar